Clackamas County Veterans Property Tax Exemption . Eligibility and the amount of the exemption typically depends on disability. your property may qualify for a special assessment deferral or tax. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes. veterans may be entitled to property tax exemption for their primary residence. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. State programs may allow you to delay paying property taxes on your. if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. property tax deferral for disabled and senior citizens. if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your.

from www.templateroller.com

if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. Eligibility and the amount of the exemption typically depends on disability. State programs may allow you to delay paying property taxes on your. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. veterans may be entitled to property tax exemption for their primary residence. property tax deferral for disabled and senior citizens. your property may qualify for a special assessment deferral or tax.

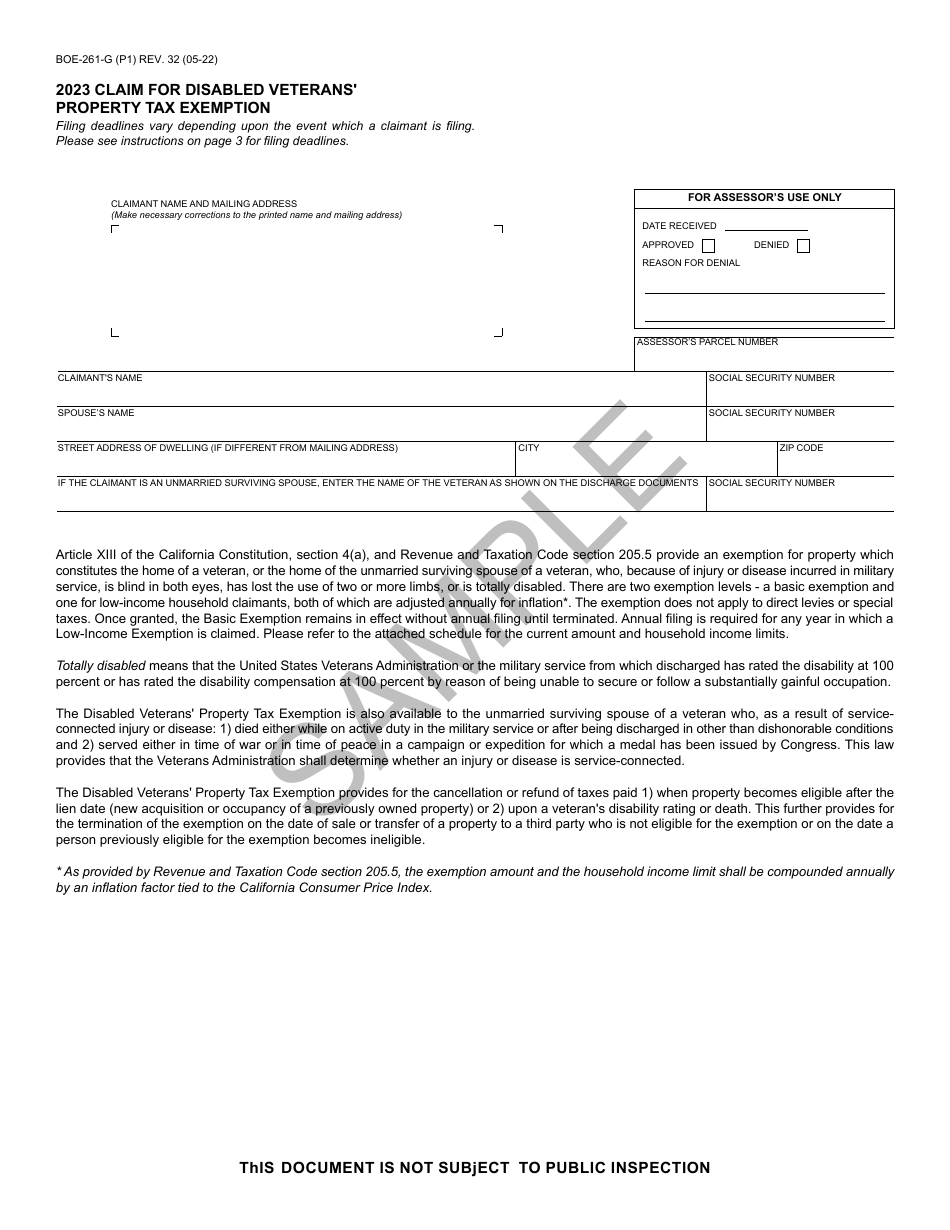

Form BOE261G Download Printable PDF or Fill Online Claim for Disabled

Clackamas County Veterans Property Tax Exemption your property may qualify for a special assessment deferral or tax. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes. State programs may allow you to delay paying property taxes on your. if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. your property may qualify for a special assessment deferral or tax. veterans may be entitled to property tax exemption for their primary residence. property tax deferral for disabled and senior citizens. if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. Eligibility and the amount of the exemption typically depends on disability.

From www.youtube.com

Texas Disabled Veteran Property Tax Exemption (EXPLAINED) YouTube Clackamas County Veterans Property Tax Exemption if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. your property. Clackamas County Veterans Property Tax Exemption.

From slideplayer.com

Veterans Property Tax Exemptions and School Taxes ppt download Clackamas County Veterans Property Tax Exemption property tax deferral for disabled and senior citizens. Eligibility and the amount of the exemption typically depends on disability. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes. State programs may allow you to delay paying property taxes on your. veterans. Clackamas County Veterans Property Tax Exemption.

From www.scribd.com

Veterans Property Tax Exemptions by Town State Mandated Exemptions Clackamas County Veterans Property Tax Exemption Eligibility and the amount of the exemption typically depends on disability. your property may qualify for a special assessment deferral or tax. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. veterans may be entitled to property tax exemption. Clackamas County Veterans Property Tax Exemption.

From www.youtube.com

Disabled Veteran Property Tax Exemptions in Texas YouTube Clackamas County Veterans Property Tax Exemption if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. your property may qualify for a special assessment deferral or tax. veterans may be entitled to property tax exemption for their primary residence. if you are a disabled. Clackamas County Veterans Property Tax Exemption.

From www.youtube.com

Property Tax Exemptions for Seniors and Veterans YouTube Clackamas County Veterans Property Tax Exemption if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. Eligibility and the amount of the exemption typically depends on disability. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property. Clackamas County Veterans Property Tax Exemption.

From www.exemptform.com

Tax Exemption Form For Veterans Clackamas County Veterans Property Tax Exemption veterans may be entitled to property tax exemption for their primary residence. State programs may allow you to delay paying property taxes on your. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes. if you are a disabled veteran, you may. Clackamas County Veterans Property Tax Exemption.

From www.scribd.com

Veterans Property Tax Exemptions by Town Total Benefit Amounts Clackamas County Veterans Property Tax Exemption State programs may allow you to delay paying property taxes on your. if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. property tax deferral for disabled and senior citizens. Eligibility and the amount of the exemption typically depends on disability. if you are a disabled. Clackamas County Veterans Property Tax Exemption.

From dxodrehvd.blob.core.windows.net

Va Property Tax Exemption New Jersey at Gilbert Hagan blog Clackamas County Veterans Property Tax Exemption Eligibility and the amount of the exemption typically depends on disability. property tax deferral for disabled and senior citizens. your property may qualify for a special assessment deferral or tax. State programs may allow you to delay paying property taxes on your. if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of. Clackamas County Veterans Property Tax Exemption.

From www.exemptform.com

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton Clackamas County Veterans Property Tax Exemption your property may qualify for a special assessment deferral or tax. if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes.. Clackamas County Veterans Property Tax Exemption.

From www.youtube.com

Veteran Property Tax Exemptions Explained YouTube Clackamas County Veterans Property Tax Exemption your property may qualify for a special assessment deferral or tax. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property taxes. property tax deferral for disabled and senior citizens. if you are a disabled veteran — or the surviving spouse of. Clackamas County Veterans Property Tax Exemption.

From www.templateroller.com

Form BOE261G Download Printable PDF or Fill Online Claim for Disabled Clackamas County Veterans Property Tax Exemption if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. State programs may allow you to delay paying property taxes. Clackamas County Veterans Property Tax Exemption.

From www.youtube.com

How to File Your Disabled Veteran Property Tax Exemption in Texas YouTube Clackamas County Veterans Property Tax Exemption if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. Eligibility and the amount of the exemption typically depends on disability. State programs may allow you to delay paying property taxes on your. veterans may be entitled to property tax. Clackamas County Veterans Property Tax Exemption.

From www.pdffiller.com

Fillable Online Clackamas County Veterans Property Tax Exemption Eligibility and the amount of the exemption typically depends on disability. State programs may allow you to delay paying property taxes on your. if you’re a disabled veteran or the surviving spouse or registered domestic partner (partner)* of a veteran, you may be entitled to exempt $25,537 or 30,646 of your. if you are a disabled veteran, or. Clackamas County Veterans Property Tax Exemption.

From www.formsbank.com

Fillable Form Boe261G (P1) Claim For Disabled Veterans' Property Clackamas County Veterans Property Tax Exemption your property may qualify for a special assessment deferral or tax. State programs may allow you to delay paying property taxes on your. Eligibility and the amount of the exemption typically depends on disability. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of your property. Clackamas County Veterans Property Tax Exemption.

From printableformsfree.com

Fillable Form Boe 261 G Claim For Disabled Veterans Property Tax Clackamas County Veterans Property Tax Exemption veterans may be entitled to property tax exemption for their primary residence. Eligibility and the amount of the exemption typically depends on disability. if you are a disabled veteran — or the surviving spouse of a veteran — you may be entitled to exempt a portion of your property taxes. property tax deferral for disabled and senior. Clackamas County Veterans Property Tax Exemption.

From www.templateroller.com

Maine Property Tax Exemption Application for Veterans of the Armed Clackamas County Veterans Property Tax Exemption if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. property tax deferral for disabled and senior citizens. State programs may allow you to delay paying property taxes on your. your property may qualify for a special assessment deferral or tax. if you are a. Clackamas County Veterans Property Tax Exemption.

From vaclaimsinsider.com

20 States with Full Property Tax Exemption for 100 Disabled Veterans Clackamas County Veterans Property Tax Exemption if you are a disabled veteran, you may be entitled to exempt some of your homestead property’s assessed value from your. State programs may allow you to delay paying property taxes on your. property tax deferral for disabled and senior citizens. if you are a disabled veteran — or the surviving spouse of a veteran — you. Clackamas County Veterans Property Tax Exemption.

From www.templateroller.com

Download Instructions for Form BOE261G Claim for Disabled Veterans Clackamas County Veterans Property Tax Exemption veterans may be entitled to property tax exemption for their primary residence. State programs may allow you to delay paying property taxes on your. your property may qualify for a special assessment deferral or tax. if you are a disabled veteran, or the surviving spouse of a veteran, you may be entitled to exempt a portion of. Clackamas County Veterans Property Tax Exemption.